Fed Slashes Rates Again Amid Economic Uncertainty

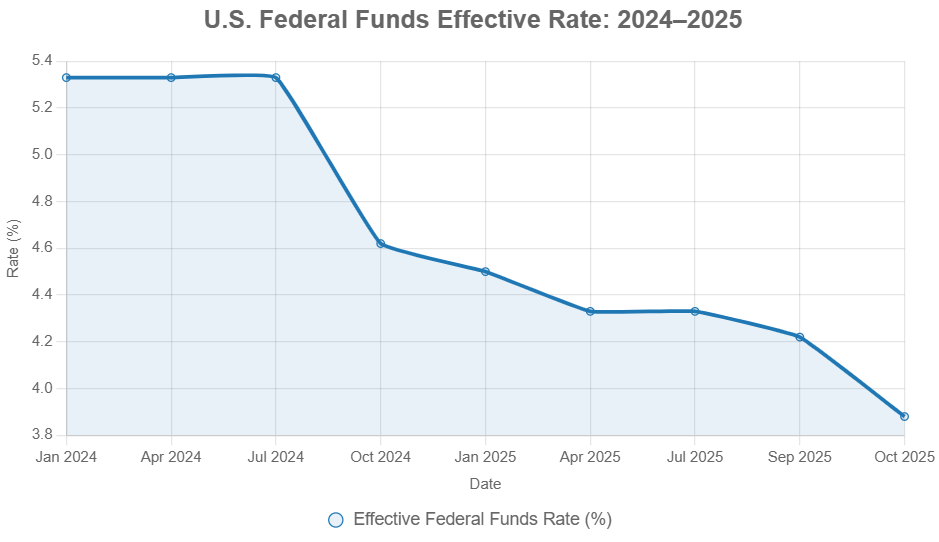

In a move that’s sending shockwaves through Wall Street and Main Street alike, the Federal Reserve has cut its benchmark interest rate for the second time in as many months, lowering the federal funds rate by 0.25 percentage points to a new target range of

3.75%–4.00%. This marks the lowest level in three years and signals a dramatic pivot from the Fed’s inflation-fighting stance of recent years.

But here’s the twist: the Fed is making these decisions in the dark. Thanks to a government shutdown that began October 1, federal agencies like the Bureau of Labor Statistics have been unable to release critical economic data, leaving policymakers “operating a little bit blind”. The usual gold-standard reports on jobs, inflation, and GDP are missing in action, creating a “data fog” that’s unprecedented in recent history.

Why Is the Fed Cutting Rates Now?

The central bank’s dual mandate—maximum employment and stable inflation—is under threat.

Hiring has stalled, unemployment is creeping up, and inflation remains stubbornly high. Businesses are passing along higher costs from tariffs, raising fears of “stagflation”—the dreaded combo of slow growth and rising prices.

Fed Chair Jerome Powell and his colleagues are betting that lower rates will help revive the labor market and keep the economy from sliding into recession. But with inflation still above the

2% target, it’s a risky gamble. The Fed’s own statement admits “uncertainty about the economic outlook remains elevated,” and policymakers are “attentive to the risks to both sides of its dual mandate”.

The Data Blackout: Flying Blind

Normally, the Fed relies on a steady stream of economic data to guide its decisions. Not this time. The government shutdown has paralyzed the release of key reports, including:

- September and October jobs data

- Consumer Price Index (CPI)

- GDP growth statistics

Without these numbers, the Fed is forced to make policy calls based on incomplete information—a situation that’s making investors and economists nervous.

Market Reaction: Volatility and Mixed Signals

The immediate market response has been a rollercoaster:

-

U.S. stocks: Growth and tech sectors saw a brief rally as borrowing costs dropped, but volatility remains high.

-

U.S. dollar: Down

10% against major currencies since January, fueling capital outflows and strengthening the euro.

-

Emerging markets: Bond flows are up as investors chase higher yields.

-

Commodities: Prices for oil and metals have risen on expectations of increased demand.

-

Banks and insurers: Facing pressure from squeezed net interest margins.

What’s Next? December Meeting in Focus

Fed Chair Powell made it clear: another rate cut in December is “not a forgone conclusion”. The path forward depends on whether the government shutdown ends and fresh economic data becomes available. If the shutdown lifts, the Bureau of Labor Statistics could release a backlog of jobs reports, which will be crucial for the Fed’s next move.

Analysts expect up to two more rate cuts by mid-2026, but caution is the watchword. The Fed is prepared to “adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals”.

What This Means for You

-

Borrowing costs: Expect lower rates on mortgages, car loans, and credit cards, but the drop may be slow to reach consumers.

-

Savings yields: Returns on savings accounts and CDs are likely to fall.

-

Real estate: Lower rates could boost home buying, but economic uncertainty may temper gains.

-

Investments: Volatility is likely to persist as markets digest the Fed’s moves and the ongoing data blackout.

Takeaway: The Fed’s High-Stakes Gamble

The Fed’s latest rate cuts are a bold attempt to steer the economy through a storm of uncertainty. With critical data missing and inflation still a threat, the central bank is taking calculated risks to support growth. Investors, businesses, and consumers should brace for more twists as the story unfolds—and keep a close eye on Washington for signs of a breakthrough in the data blackout.

Sources

1. Federal Reserve issues FOMC statement

2. The Fed - FOMC meeting commentary September 2025 - Nuveen

3. The Fed makes a second interest rate cut. Here's what will

4. Global Markets Brace for Impact as Fed Rate Cuts Meet 'Data Fog'

5. Fed cuts interest rates for 2nd time this year, but ... - ABC News

6. What Fed rate cuts mean for your money - Ameriprise Financial

7. Fed Cuts Rates to Three-Year Low as Government Shutdown ...

8. Federal Reserve Pivots to Easing: Second Rate Cut of 2025 Signals ...

9. Here's How the Fed's Rate Cut Will Impact Real Estate During the ...