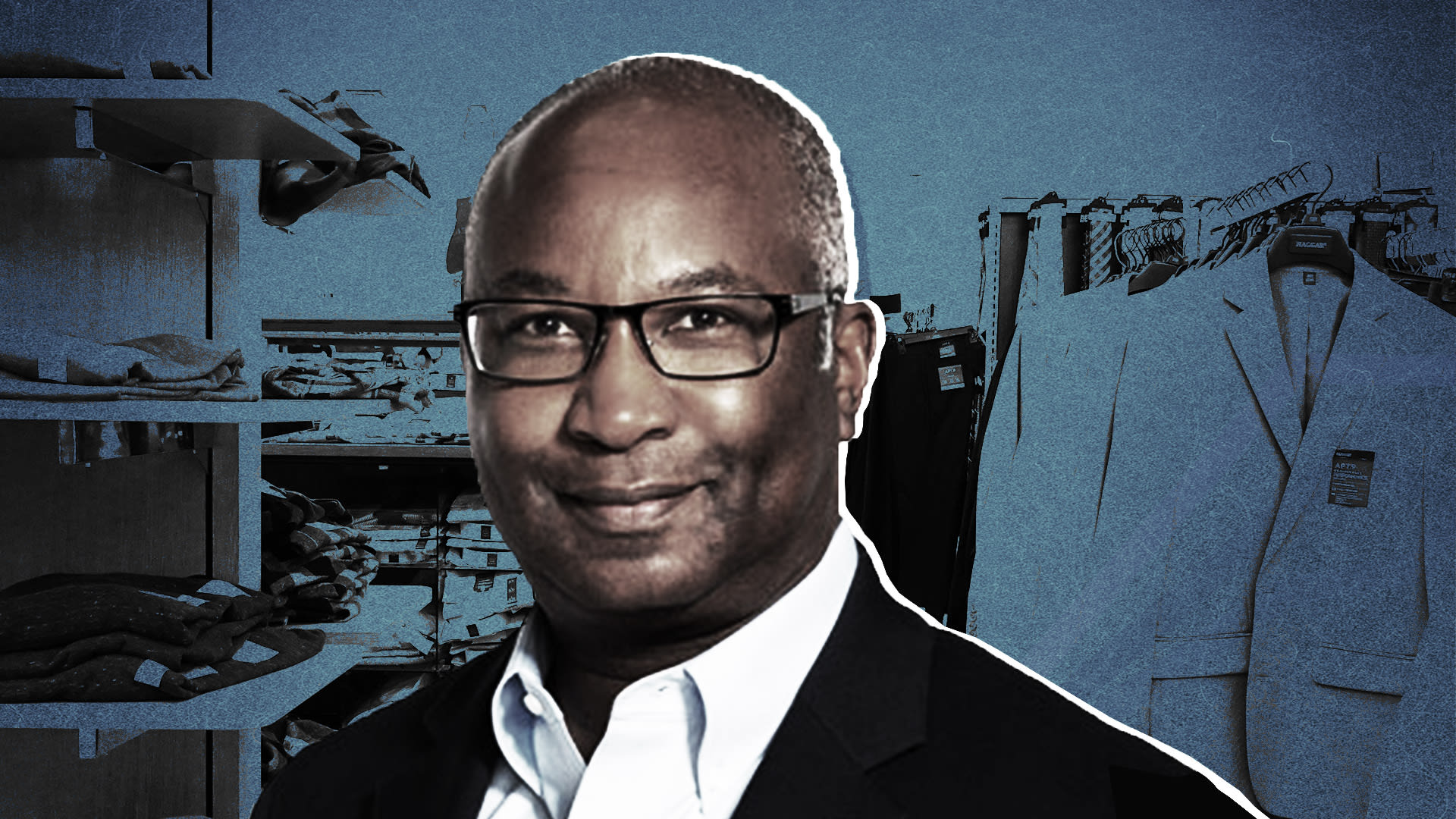

Michael Bender is inheriting a department store in distress, but recent earnings suggest the bleeding might finally be slowing. After taking the helm of Kohl's in late November, the newly promoted CEO is facing a critical moment: the retailer has now endured 15 consecutive quarters of sales deterioration, a trajectory that eerily mirrors the downfalls of retail giants like J.C. Penney and Sears. Yet there's a glimmer of hope emerging from the holiday season that could reshape the narrative.

A Turnaround in the Making

The numbers tell a cautiously optimistic story. In Q3 fiscal 2025, Kohl's reported net sales of

$3.4 billion, down just

2.8% year-over-year, while comparable sales fell a modest

1.7%—a marked improvement from the steeper declines investors had feared. More impressively, the company raised its full-year guidance, now expecting net sales to decline between

3.5% and

4%, a significant improvement from the previously anticipated 5% to

6% drop.

The market responded enthusiastically, with Kohl's shares surging

35% on the back of these revised forecasts. This wasn't just about managing decline—it was about demonstrating that management finally understands what went wrong and how to fix it.

The Secret Sauce: Bringing Back What Customers Actually Want

Here's where Bender's strategy becomes particularly interesting. Kohl's had spent years chasing trends and abandoning the reliable categories that built its reputation.

Women's apparel, jewelry, and petite clothing—the bread-and-butter merchandise that kept customers coming back—were de-emphasized in favor of what executives thought would drive growth.

The turnaround began when management realized this was a catastrophic mistake. By restoring assortment in these core product categories, Kohl's started winning back shoppers who had drifted to competitors. This wasn't flashy innovation; it was retail fundamentals executed correctly. And it's working. October comparable sales actually turned positive, up

1%, a remarkable achievement given that the company is cycling three years of prior-year declines in the fourth quarter.

The Profit Margin Puzzle

While top-line growth remains elusive, Bender has demonstrated impressive operational discipline.

Gross margin expanded by 51 basis points to 39.6% in Q3, achieved through meticulous inventory management and cost discipline. Operating income for the nine-month period jumped to

$412 million from

$307 million in the prior year, while net income more than doubled to

$147 million from

$61 million.

This suggests Bender isn't just cutting his way to profitability—he's optimizing the business model while simultaneously rebuilding customer appeal.

The Road Ahead: Stability Comes With a Price

Analysts are cautiously encouraged. Dana Telsey of Telsey Advisory Group called the raised guidance an "encouraging sign" that Kohl's is figuring out how to recapture market share, though she cautioned that the real work of winning back shoppers would take considerable time.

The challenge ahead is formidable. After 15 consecutive quarters of sales declines, investor patience is wearing thin. Bender will need to prove that this quarter's momentum isn't a seasonal blip but the beginning of genuine recovery. The holiday season will be crucial—if Kohl's can maintain positive comparable sales through the critical fourth quarter, it could signal that the turnaround is real.

There's also the matter of employee stability. To truly transform the business, Kohl's may need to make difficult decisions that could affect workforce security, even as the company stabilizes financially. It's a delicate balance between financial recovery and organizational morale.

What This Means for Retail

Kohl's story matters beyond its own balance sheet. The department store sector has been written off by many investors, with the assumption that the category is simply dying. But Kohl's recent performance suggests that with the right leadership, the right product mix, and genuine customer focus, even a struggling retailer can find its footing.

The next few quarters will be telling. If Bender can sustain this momentum and actually return the company to growth, he'll have accomplished something many thought impossible. If not, Kohl's may join the graveyard of once-iconic American retailers.

For now, though, the new CEO has earned the right to be cautiously optimistic—and so have investors who've been waiting years for good news.

2.

Despite Green Shoots, Kohl's New CEO Faces Tough Slog to Win Back Shoppers3.

Kohl's Rises As Higher Sales Signal Positive Holiday Trends

Sources

1. Kohl's raises FY25 financial forecast, names Michael Bender as CEO

2. Despite some green shoots, the new CEO of Kohl's faces a tough slog to win back its AWOL shoppers

3. Kohl's Rises As Higher Sales Signal Positive Holiday Trends (Nov ...

4. Kohl's Appoints Michael J. Bender as Chief Executive Officer