PayPal Holdings, Inc. (NASDAQ: PYPL) has been making headlines recently with a notable increase in its stock price and the launch of innovative AI-driven commerce services. As of late October 2025, PayPal's stock price has shown a significant rise, reflecting investor optimism about the company's future prospects.

Recent Stock Performance

PayPal's stock price has experienced a recent surge, with the stock trading at around

$70.25 as of late October 2025. This increase follows a period where the stock had previously closed at

$67.41 before rising to

$69.20 with a high of

$69.47. The stock's performance is closely watched due to its significant market presence and influence in the financial technology sector.

Q3 Earnings and Guidance

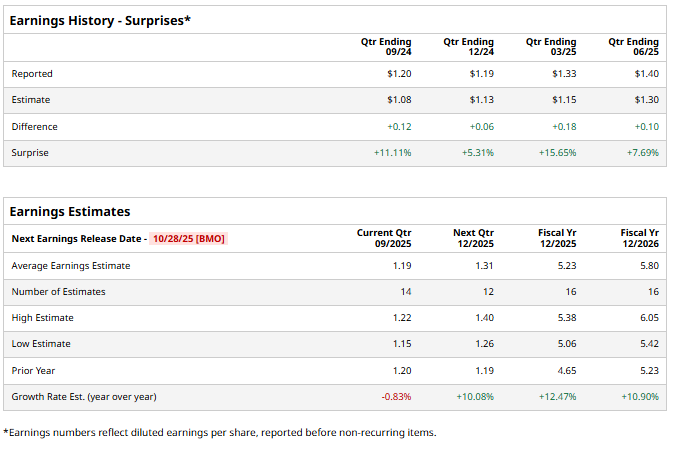

PayPal recently reported its Q3 2025 earnings, which included the launch of

Agentic Commerce Services, designed to power AI-driven shopping experiences. The company's earnings guidance for Q3 2025 is set between

$1.180 and $1.220 EPS, with a full-year guidance of

$5.150 to $5.300 EPS. Analysts have generally maintained a positive outlook on the stock, with several reiterating "buy" ratings and setting price targets ranging from

$74 to $96.

Analyst Ratings and Market Outlook

PayPal's stock has received mixed ratings from analysts, with sixteen analysts rating it as a "buy," twelve as "hold," and three as "sell". The average price target for the stock is

$83.44. Despite underperforming the market over the past year, PayPal has shown a strong recovery in recent weeks, outperforming the broader market with an

11.6% return over the past two weeks.

What This Means

The recent surge in PayPal's stock price and the introduction of AI-driven services signal a promising future for the company. As the financial technology sector continues to evolve, PayPal's strategic moves are likely to influence investor sentiment and market trends.

Future Implications

-

Innovation and Growth: PayPal's focus on AI-driven commerce could lead to increased market share and revenue growth.

-

Investor Confidence: The recent stock price increase reflects growing investor confidence in PayPal's strategic direction.

-

Market Competition: The company's ability to innovate and adapt to changing market conditions will be crucial in maintaining its competitive edge.

Conclusion

PayPal's recent stock performance and strategic initiatives highlight the company's efforts to stay ahead in the rapidly evolving fintech landscape. As investors continue to monitor the company's progress, PayPal's ability to execute its AI-driven strategies will be key to sustaining growth and investor confidence.

Sources

1. News - PayPal Holdings, Inc.

2. PayPal (NASDAQ:PYPL) Stock Price Up 2.7% - MarketBeat

3. PYPL Stock Quote | Price Chart | Volume Chart Paypal Holdings

4. PayPal Holdings Inc Stock Price Today | NASDAQ: PYPL Live

5. PYPL | PayPal Holdings, Inc. Common Stock Data, Price & News

6. PayPal Stock Price: Live Updates & Analysis

7. PayPal Q3 Earnings Preview: Should You Buy the Stock Now or Wait?