Lucid Motors Delivers Record Growth—But Challenges Remain

Lucid Motors, the luxury electric vehicle (EV) maker often dubbed a "Tesla rival," has just posted its third-quarter 2025 results, and the numbers are turning heads across the auto industry. The company reported a

net loss of $978.4 million for Q3, a slight improvement from last year, but the real story is in its

soaring revenue and production figures. Lucid’s revenue jumped to

$336.6 million, up a staggering

68% year-over-year, while vehicle production more than doubled, hitting

3,891 units—a

116% increase. Deliveries also surged

47%, reaching

4,078 vehicles for the quarter.

Despite these impressive gains, Lucid trimmed its annual production guidance to around

18,000 vehicles, down from previous targets. The company cited ongoing supply chain disruptions and the complex launch of its new Gravity SUV as key factors. Still, Lucid’s leadership remains optimistic, pointing to a strong cash reserve of

$5.5 billion and a clear path for future growth.

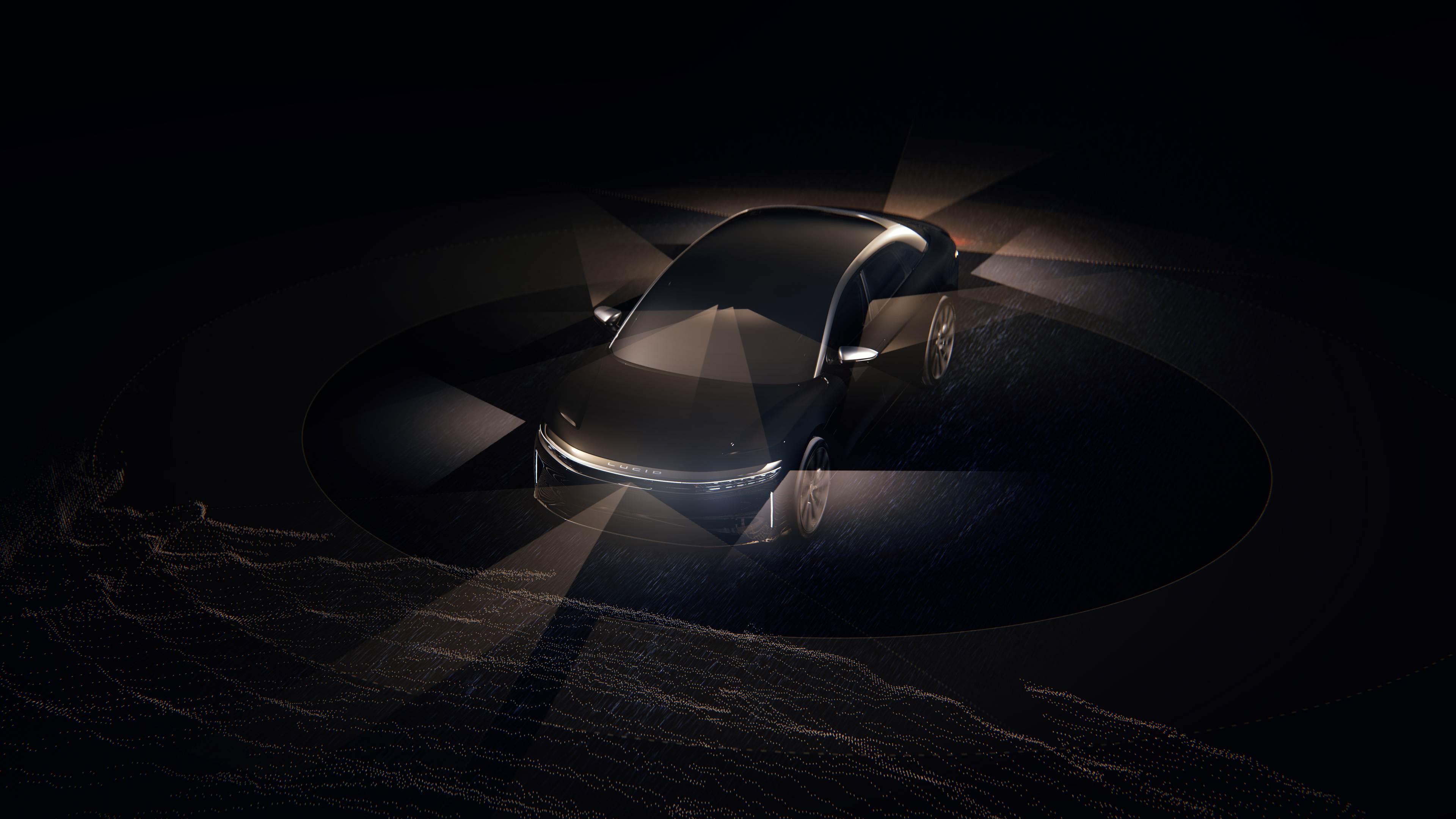

Autonomous Driving: Lucid’s Next Frontier

One of the most exciting developments is Lucid’s aggressive push into

autonomous driving technology. The company announced a partnership with

Nvidia to integrate its Drive AV platform into Lucid’s upcoming midsize EVs, aiming for

Level 4 autonomy—meaning vehicles could operate without human intervention in most scenarios. Lucid plans to equip these models with advanced sensors and Nvidia’s powerful Drive AGX Thor units, positioning itself at the forefront of intelligent mobility.

But that’s not all. Lucid also secured a

$300 million investment from Uber to develop a premium robotaxi platform. The plan? Manufacture autonomous Lucid vehicles in Arizona and deploy them exclusively on Uber’s ride-hailing network, with over

20,000 Lucid robotaxis expected to hit the streets within six years. The first city launch is slated for 2026, marking a major leap into the future of urban transportation.

Leadership Shakeup and Global Expansion

To fuel its ambitious growth, Lucid announced several

organizational changes. Emad Dlala was promoted to Senior Vice President, Engineering and Digital, overseeing all vehicle development and software. Erwin Raphael now leads global sales and service, while Marnie Levergood joins as Senior Vice President, Quality, bringing experience from major automakers like Stellantis and Magna.

Lucid’s expansion isn’t limited to the U.S.—the company is ramping up operations in

Saudi Arabia, with over 1,000 vehicles built for final assembly there in Q3. This move signals Lucid’s intent to become a truly global EV powerhouse.

What This Means for EV Buyers and Investors

For consumers, Lucid’s rapid growth and tech-forward strategy mean more choices in the luxury EV market, with advanced features like autonomous driving on the horizon. However, supply chain issues and production challenges could impact availability and pricing in the near term.

For investors, Lucid’s narrowing losses and robust revenue growth are promising, but the company’s recent

$875 million debt offering and a recall of 865 Air sedans over a rearview camera issue have sparked volatility in its stock price. The road ahead is ambitious, but not without bumps.

Actionable Takeaways and Future Outlook

-

Lucid is doubling down on autonomous tech, with Nvidia and Uber partnerships set to reshape urban mobility.

-

Production and deliveries are surging, but supply chain and launch challenges remain.

-

Leadership changes and global expansion point to a company preparing for the next phase of growth.

-

Investors should watch for further updates on the Gravity SUV launch and autonomous vehicle milestones.

Lucid Motors is betting big on innovation and scale. If it can navigate the current headwinds, the company could redefine what luxury and intelligence mean in the EV era.

Sources

1. Lucid Motors trims Q3 2025 loss as revenue and ...

2. The Car Expert | News | Reviews | Expert car advice

3. Lucid reports revenue growth but tightens production ...

4. Digital Newspaper 45283

5. Lucid Motors Q3 2025 Results: Strong Growth, Losses Persist

6. 2022-23 Rogue Valley Plug-in Buyers' Guide

7. Lucid Announces Organizational Changes to Accelerate ...

8. ERIC KIM – Page 77

9. News

10. Car UK - January 2021 | PDF | Fuel Economy In Automobiles

11. Here's why Lucid Group's (LCID) stock is falling today

12. Why is Lucid stock falling? Is it due to car recall or on new ...