UnitedHealth Group (NYSE: UNH), once a stalwart of the healthcare sector, is facing a year of dramatic swings—beating earnings expectations in Q3 2025 but still watching its stock price tumble to multi-year lows. What’s behind this paradox, and what does it mean for investors as the company heads into 2026?

Q3 Earnings: Numbers Up, Sentiment Down

On October 28, UnitedHealth Group reported

third quarter revenues of $113.2 billion, marking a robust

12% year-over-year increase. Adjusted earnings per share (EPS) came in at

$2.92, with net earnings at

$2.59 per share. The company also raised its full-year 2025 outlook, now projecting at least

$14.90 in net earnings per share and

$16.25 in adjusted EPS for the year.

CEO Stephen Hemsley struck an optimistic tone, emphasizing UnitedHealth’s “solid execution” and a renewed focus on “durable and accelerating growth in 2026 and beyond”.

But Wall Street’s reaction has been anything but enthusiastic.

Stock Price in Freefall

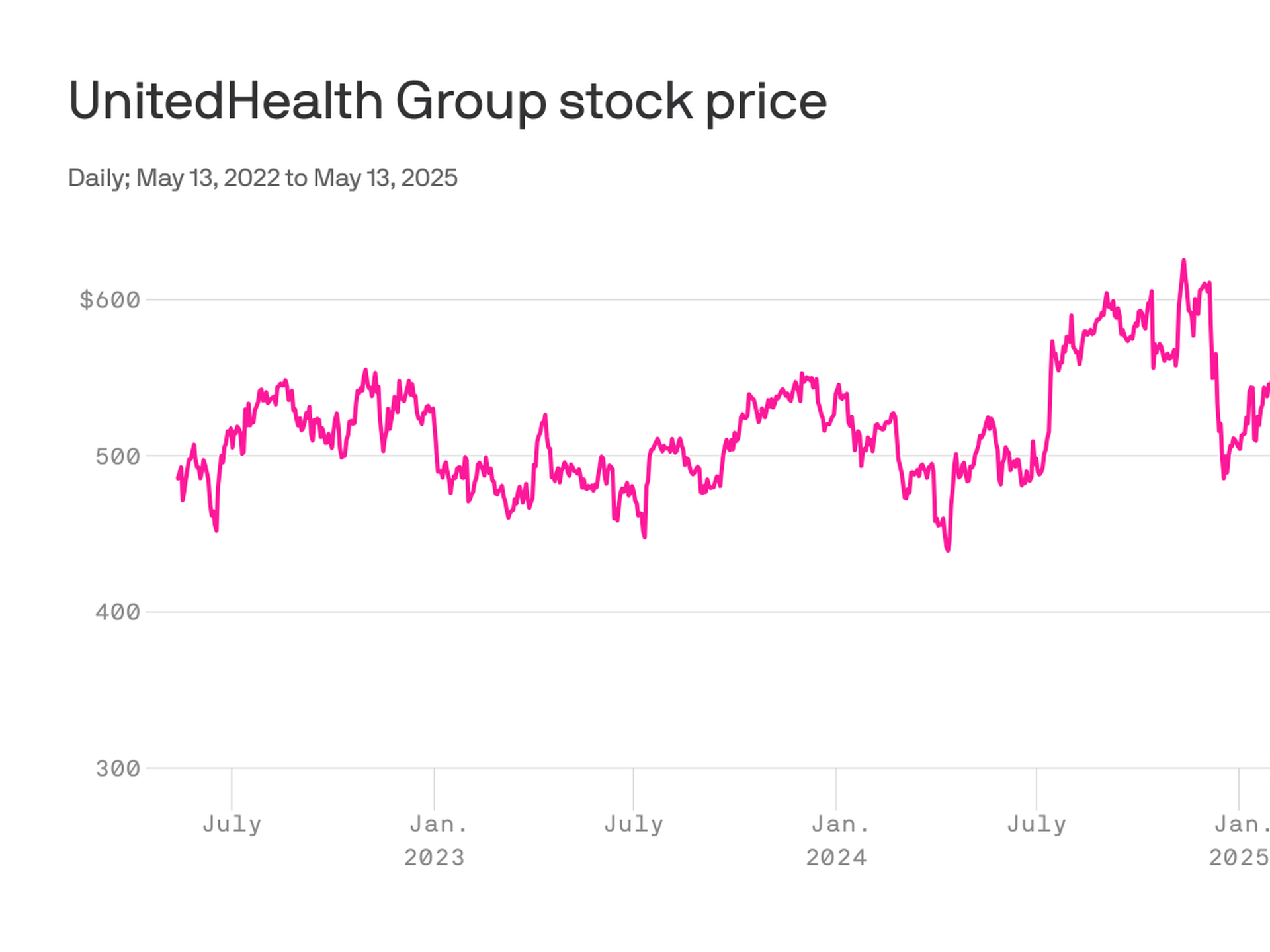

Despite the upbeat earnings report,

UNH stock has been battered in 2025, plunging nearly 30-40% year-to-date. The stock recently hit a 52-week low in August and continues to underperform the broader market. Technical analysts point to a “death cross”—where the 50-day moving average falls below the 200-day average—as a sign of sustained bearish momentum.

Recent trading data shows UNH hovering around

$280.73, down sharply from its monthly high of

$326.55. Forecasts suggest further volatility, with some models predicting a possible dip to

$265.66 in the coming weeks.

Why the Disconnect? Earnings Misses and Analyst Skepticism

The root of investor anxiety lies in

a string of negative earnings surprises. UNH has missed Wall Street’s consensus estimates in two of the last three quarters, with the most recent miss at -

15.7%. Analyst expectations for Q3 had already been slashed by over

45% in the past two months, reflecting deep pessimism about the company’s near-term prospects.

The trailing four-quarter average earnings miss stands at -

3.3%, and the company’s price-to-earnings (P/E) ratio of 22.42 is well below the industry average of 46.60, signaling a lack of confidence in future growth.

Mounting Headwinds: Legal, Regulatory, and Cost Pressures

UnitedHealth’s woes aren’t just about missed earnings. The company faces a

cascade of risks:

-

Cost inflation in healthcare services

- Ongoing

legal probes and regulatory scrutiny

- Operational challenges and rising competition

Even Berkshire Hathaway’s recent investment in UNH, which briefly buoyed the stock, hasn’t been enough to offset these concerns.

Should Investors Buy, Sell, or Hold?

Market sentiment is overwhelmingly cautious. Some analysts warn that UNH is a “value trap”—cheap for a reason, with little sign of a turnaround until the company can consistently beat earnings and resolve its legal and operational challenges.

Technical indicators and analyst forecasts suggest more downside risk in the short term, with only modest potential for a rebound if the company can deliver positive surprises in 2026.

What’s Next for UnitedHealth Group?

-

Investors should brace for continued volatility as UnitedHealth navigates a challenging landscape.

- The company’s raised earnings outlook is a bright spot, but Wall Street wants to see consistent execution and fewer negative surprises.

- Regulatory and cost pressures will remain front and center as the healthcare sector faces broader scrutiny.

For now, UnitedHealth Group’s stock story is a cautionary tale: even industry giants aren’t immune to market skepticism when growth and stability come into question.

Sources

1. [PDF] UnitedHealth Group Reports Third Quarter 2025 Results and Raises ...

2. UnitedHealth Group (UNH) Stock Forecast & Price Targets

3. Pre-Market Earnings Report for October 28, 2025 : UNH, NEE, AMT ...

4. Bear of the Day: UnitedHealth Group (UNH) - Nasdaq

5. UnitedHealth Recovers Its Rhythm Before Q3 Earnings: Time to Buy?

6. Is UnitedHealth Stock a Buy, Sell, or Hold for July 2025?

7. Newsroom - Baird