Prediction markets are no longer a fringe curiosity—they’re now at the center of a financial revolution. In a move that’s sending shockwaves through both Wall Street and the crypto world, the owner of the New York Stock Exchange (NYSE), Intercontinental Exchange (ICE), has announced an investment of up to $2 billion in Polymarket, the world’s largest cryptocurrency-based prediction market. This bold bet comes just as Polymarket secures regulatory approval to return to the U.S. after years of legal wrangling.

Polymarket’s Wild Ride: From Regulatory Exile to Wall Street Darling

Polymarket, founded in 2020 and headquartered in New York, lets users bet on the outcomes of everything from elections and economic indicators to pop culture and sports. The platform uses cryptocurrency (USDC) and the Polygon blockchain, making it a favorite among crypto-savvy traders.

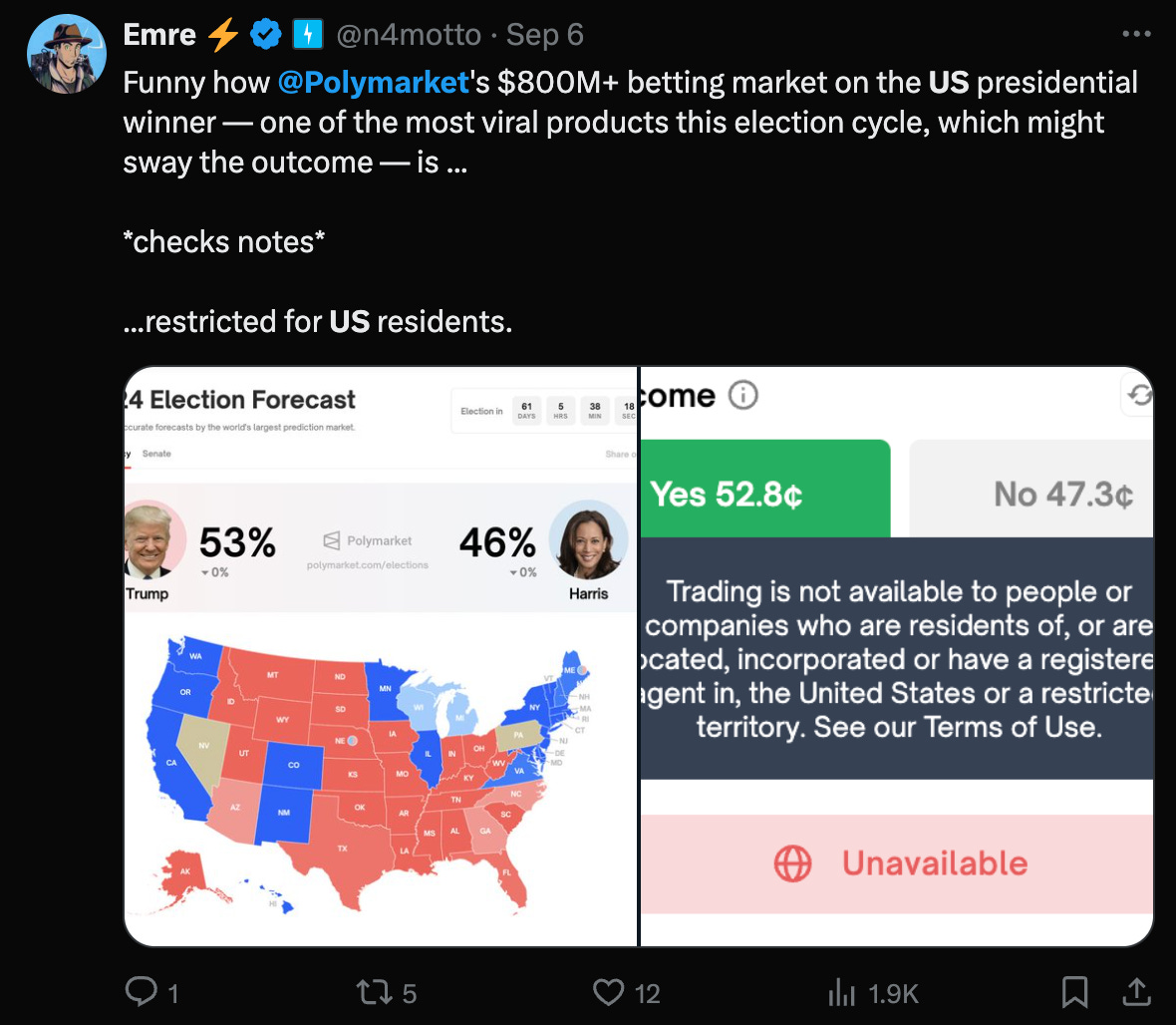

But its journey hasn’t been smooth. In 2022, the Commodity Futures Trading Commission (CFTC) forced Polymarket to block U.S. users and settle charges of running an unregistered derivatives platform. The company shifted operations offshore, but regulatory headaches followed it around the globe, with bans and blocklists cropping up in Europe and Asia.

That all changed in July 2025, when the CFTC and Department of Justice ended their investigations without new charges. Polymarket then acquired QCEX, a CFTC-licensed derivatives exchange, for

$112 million—paving the way for a legal return to the U.S. market. In September, the CFTC granted Polymarket a no-action letter, officially giving it the green light to operate stateside through its new acquisition.

Wall Street’s Billion-Dollar Vote of Confidence

The timing of ICE’s investment couldn’t be more symbolic. With the regulatory fog lifting, Wall Street’s biggest players are racing to get a piece of the prediction market action. ICE’s up-to-$2 billion stake is a clear signal that institutional finance sees prediction markets as the next big thing—not just a speculative playground for crypto enthusiasts.

Polymarket’s main rival, Kalshi, recently hit a $2 billion valuation after a

$185 million funding round led by crypto giant Paradigm, with backing from Sequoia Capital and Citadel Securities CEO Peng Zhao. Even traditional brokers like Robinhood and Interactive Brokers are launching event contracts, while CME Group has teamed up with FanDuel to offer

$1 event contracts to sports betting fans.

Why Prediction Markets Are Booming

So, what’s driving this frenzy? Prediction markets let users trade contracts on real-world events—think “Will Google have the top AI model by October 31?” or “Will Tesla beat quarterly earnings?”. Unlike traditional gambling, users aren’t betting against the house; they’re trading with each other, and contracts pay out $1 if the event happens.

Supporters argue that prediction markets are more accurate than polls because people put real money behind their beliefs. Critics, however, still see them as “digital casinos” and worry about the gambling-like structure.

But with CFTC Acting Chairman Caroline Pham calling prediction markets “an important new frontier,” and Wall Street pouring in billions, the tide is turning.

What’s Next for Polymarket and the Industry?

Polymarket’s return to the U.S. and ICE’s massive investment mark a new era for prediction markets. With regulatory clarity and Wall Street backing, these platforms could soon rival traditional financial markets in both scale and influence.

Key questions remain: Will prediction markets become a staple of mainstream investing, or will regulatory and ethical concerns slow their growth? For now, one thing is clear—betting on the future has never looked more lucrative.

Sources

1. Breaking News - Polymarket

2. Polymarket - Wikipedia

3. Prediction Market Giant Polymarket Gets CFTC Green Light for US ...

4. New York Stock Exchange Owner Nears $2B Stake in Polymarket

5. NYSE Owner Investing Up To $2 Billion In Polymarket